Community-at-a-Glance

0

HOMES

0

LAND

0

PONDS

0

TRAILS

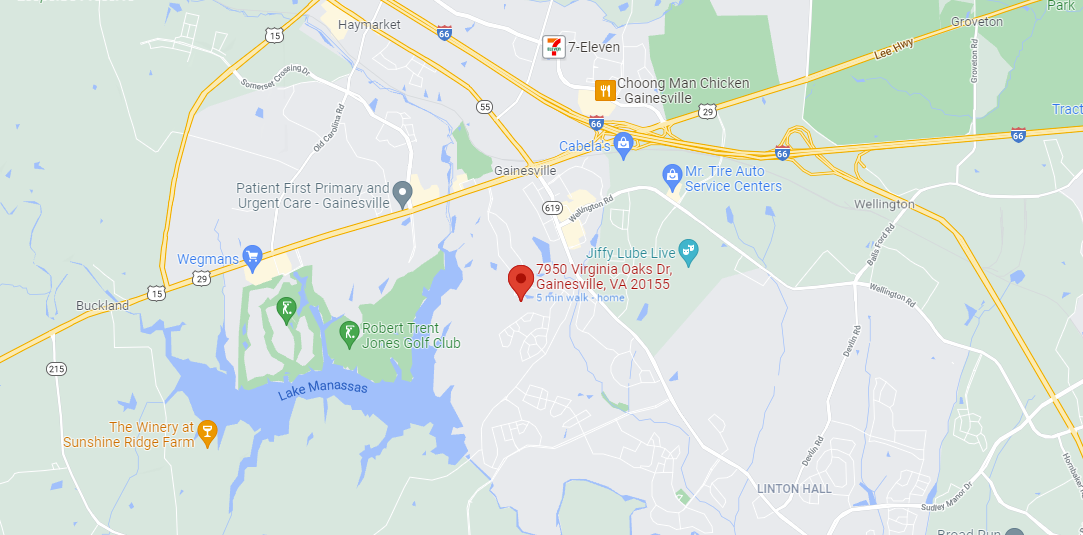

Location